All actively managed good funds go through temporary periods of underperformance. In most cases, this temporary underperformance phase is followed by a phase of outperformance which adequately overcompensates for the underperformance. This is how good equity funds end up outperforming over the long term.

But that being said there are also weak funds that go through periods of underperformance. In this case, this underperformance phase usually sustains for a long period of time, and occasional temporary outperformance if any does not compensate for the long period of underperformance. Inevitably these weak equity funds end up underperforming over the long term.

Here comes the real question that matters to your clients…

How do we differentiate between a good fund going through temporary underperformance vs a bad fund going through sustained underperformance?

This is a very important question as most of your clients end up exiting good funds during their underperformance phase and miss out on the outperformance phase which inevitably follows. The worst part is that we move into new funds based on strong recent performance only to see mean reversion play out (i.e the new funds entering their phase of underperformance), resulting in lower future returns and a bad experience.

But at the same time, if your clients don’t move out from a bad fund that is underperforming, they might be stuck with a long-term underperformer creating permanent damage to their long-term returns.

How do we solve this problem?

Let us break this down and start with a more basic question.

How do we identify a good fund i.e a fund with higher odds of future outperformance over the next 5-7 years?

Here is a simple checklist that your clients can use to identify a good fund:

- Is there historical evidence that the fund outperforms over long periods of time? (check rolling returns over 5Y, 7Y & 10Y)

- Over time, has the fund managed risk well?

- Does the fund manager have a long-term track record?

- What is the investment philosophy and has it remained consistent across market cycles?

- Does the fund have a low portfolio churn?

- Is the fund available at reasonable valuations?

- What is the current portfolio positioning?

- Does the fund communicate transparently and regularly?

If any fund fares well in all the above parameters and is going through near-term underperformance, then this fund might be a good mean reversion candidate with a strong potential for higher returns in the coming years.

Instead of making this a theoretical exercise let us apply the checklist to an actual fund and check how this works.

Let us evaluate Franklin India Prima Fund for this analysis.

Franklin India Prima Fund – Significant Underperformance in the last 3, 5 & 7 years

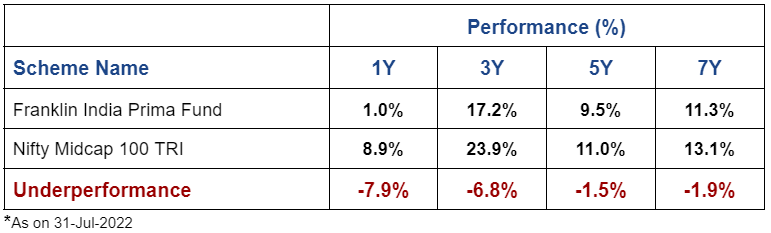

As seen above, the Franklin India Prima fund has underperformed its benchmark by 1-2% over the last 5 years and 7 years. It is also lower-rated (2-star or 3-star rated) across most mutual fund rating platforms which is in effect a reflection of weak recent performance.

So that leaves us with the question – Is this a good fund going through temporary underperformance vs a bad fund going through sustained underperformance?

Putting Franklin India Prima Fund to the test

Question 1: Is there historical evidence that Franklin India Prima fund outperforms over long periods of time?

As seen above, the fund has

As seen above, the fund has

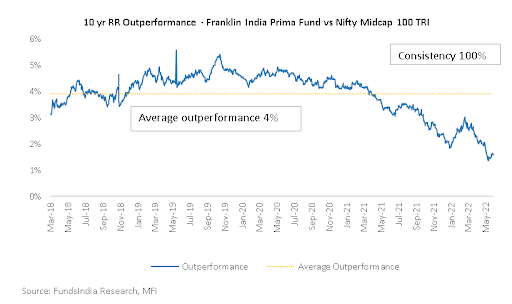

- Always outperformed the benchmark on a 10-year rolling returns basis – with an average outperformance of 4%

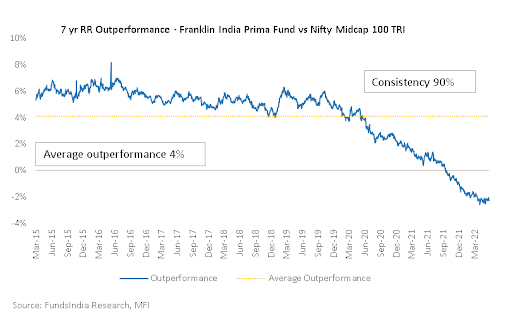

- Outperformed the benchmark 90% of the time on a 7-year rolling returns basis – with an average outperformance of 4%

So historical evidence shows that Franklin India Prima fund has consistently outperformed over long periods of time.

Question 2: How has Franklin India Prima Fund managed risks?

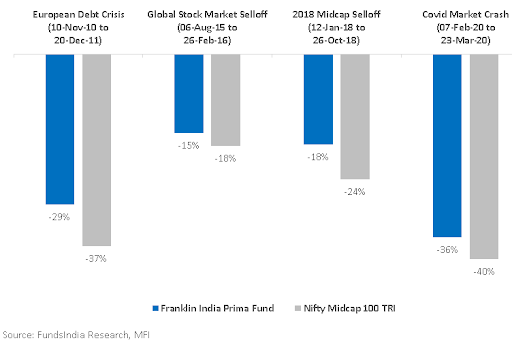

While this involves some qualitative nuances, a rough proxy would be to check for declines during major market falls. If the fund has fallen lower than the benchmark this usually indicates a conservative approach and good risk management.

As seen above the fund has had lower falls relative to the benchmark during past major market declines.

Overall, we don’t see any major concerns on the risk management side and the fund has managed its risks well across market cycles. The fund has stuck to its valuation-conscious approach with a focus on acceptable quality & growthand hasn’t made any big irreparable mistakes in the past.

Question 3: What is the Fund Manager Janakiraman’s Track Record and Tenure in managing this fund?

- Fund Manager Name: Mr.R.Janakiraman

- Managing Franklin India Prima Fund Since: 11-Feb-08

- Returns since FM inception tenure (as on 31-Jul-2022): 13.4%

- Outperformance vs Benchmark (under FM tenure): 1.2%

The fund manager Janakiraman is an experienced mid and small cap specialistwith a solid track record and has been managing this fund for around 14+ yearssince Feb 2008. Since the time he has been managing the fund has given 13.4% returns and outperformed its benchmark by 1.2%.

Question 4: What is the investment philosophy and has it remained consistent across market cycles?

Janakiraman’s investment philosophy can be summed up as

• Sustainable, Good Quality Businesses with Strong Growth Prospects…

Invests in businesses with an acceptable level of quality, growth, and sustainability. These are businesses that are characterised by an attractive return on capital, relatively lower capital intensity, ability to generate free cash flows, attractive growth potential, consistent execution, and capable management

• …at Reasonable Valuations

The fund however tries to avoid good-quality businesses at very expensive valuations.

While this is a subjective assessment, we think the fund has stood the test of time and has been able to execute its investment philosophy consistently even through periods where the style was not in favor (e.g. 2017, 2020, 2021).

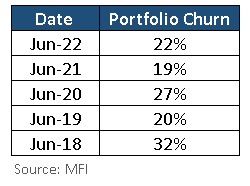

Question 5: Are there any drastic changes in the portfolio as a result of the recent underperformance?

This can be verified using portfolio turnover as a proxy. The portfolio turnover ratio measures the extent to which a fund manager churns the portfolio over the last one year. Portfolio turnover is calculated by taking the lower of the total of new stocks purchased or sold over 12 months, divided by the fund’s average assets under management (AUM).

Usually, a low portfolio turnover implies low churn, strong fund manager conviction on the stock picks, and a ‘buy and hold’ strategy.

Franklin India Prima as seen over the last 5 years has had a low portfolio turnover ratio reiterating its high conviction buy and hold strategy. The fund portfolio has remained stable and we don’t see any drastic portfolio changes due to recent underperformance.

If instead, the portfolio churn is high, then there is no point trying to judge the current portfolio in detail as this will keep changing and in this case, we become more dependent on the fund manager’s judgement and ability to consistently identify the right sectors and stocks.

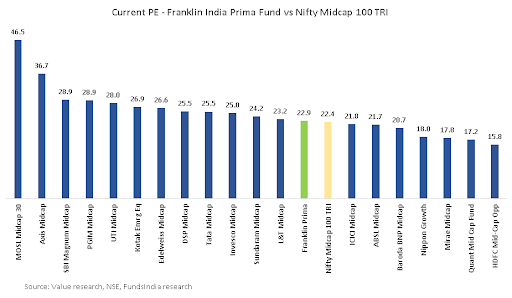

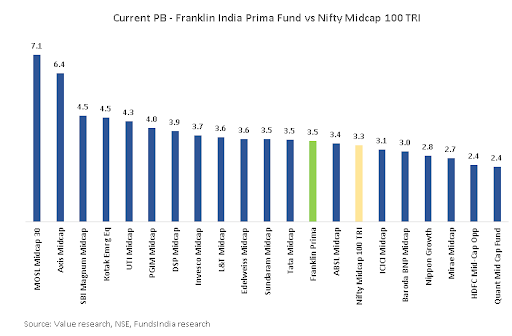

Question 6: Is the fund available at reasonable valuations?

The fund has a Price to Earnings Ratio of 22.9x as against the benchmark PE of 22.4x

The fund has a Price to Book ratio of 3.5x as against the benchmark PB of 3.3x

While this is still a crude measure, the fund looks reasonably valued with PE & PB, on par with the benchmark index.

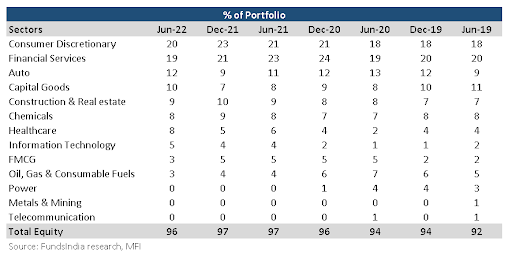

Question 7: What is the reason for underperformance and how is the portfolio currently positioned?

What explains the underperformance?

The underperformance was on account of 2 factors – The investment Style of the fund & Few Sectoral Choices

Style underperforms in momentum-driven phases of the market

- As seen from history, the fund’s investment style tends to underperform in momentum-driven market phase (seen in 2020 & 2021) given the valuation consciousness

Sectoral calls that led to underperformance

• Overweight in mid & small cap banks:

Has not played out due to concerns on covid led disruption, credit quality concerns, low credit growth, and fintech disruption risks. The good part is, that most of these concerns are behind us.

• Overweight in consumer discretionary sector:

Margins of this sector were impacted on account of commodity price rise. The recent fall in commodity prices is a positive.

• High direct and indirect exposure to real estate:

Increase in commodity prices and cement price impacted the expected recovery as the cost increases were not passed on to the consumers. The recent fall in commodity prices is a positive.

• Overweight in Auto:

The auto sector was on a decline for the last 2-3 years, driven by the NBFC crisis, covid demand impact, regulatory emission norms, rise in input costs, and chip shortages.

• Underweight in sectors like IT, Chemicals, Pharma, FMCG, Metals & Electronic manufacturing service companies (EMS) also impacted the performance

How to evaluate the future potential?

We don’t want to go overboard in trying to evaluate each and every stock as it defeats the whole purpose of hiring a few good fund managers to do this job.

So we will broadly evaluate this with 2 lenses

- Where are we in the business cycle for major sectors/stocks (Early Cycle, Mid Cycle, Late Cycle)

- Where are we in the valuation cycle for this portfolio (Cheap, Reasonable, Expensive)

The valuation part is already covered in the previous question and we saw that valuations are reasonable at a portfolio level.

Coming to evaluating the business cycle, if most sectors/stocks are in the early business cycle and valuations are reasonable or cheap, then we can conclude that the future potential for outperformance is strong for this fund.

Let us check how this works in reality:

• Consumer Discretionary (20%): Long-term Structural play on Indian Consumption Story. Predominantly played via Home Improvement, Fashion Retailers, Hotels, Alcohol, Food Chains, etc. Was recently impacted due to margin pressures from higher commodity prices. Following the recent fall in commodity prices, margins are expected to stabilize.

• Financials (19%): Mid & Small cap Banks underperformed due to Covid-led disruption, credit quality concerns, low credit growth, and fintech disruption risks. The sector fundamentals are gradually improving both in terms of credit growth and credit quality. Early signs indicate that we may be at the cusp of the next credit cycle. Improving fundamentals and reasonable valuations indicate a strong future potential for this segment.

• Auto (12%): Auto sector was on a decline for the last 2 years, driven by rising in input cost, chip shortage, and Covid impact. We might be close to the bottom of the cycle – early signs of revival are visible.

• Capital Goods (10%): Play on economic recovery and Capex revival. We are currently close to the bottom of the cycle. There is a revival seen for capital expenditures, driven primarily by the government, PLI schemes, and to a lesser extent by the private sector. Manufacturing, defence, energy, transportation, and urban infrastructure are expected to receive the maximum share of the capital expenditure.

• Real Estate & Cement (9%): Early signs of real estate revival are visible – Improving affordability, RERA, supply consolidation, and low borrowing rates. Close to the bottom of the cycle and early signs of recovery are already visible.

• Chemicals (8%): 4% of the portfolio is into fertilizers as a proxy to play rural consumption and the remaining 4% of the portfolio is in outsourcing chemical theme benefiting from the China+1 trend.

• Defensives: Healthcare (8%) + IT (5%) + FMCG (2%) : The fund continues to be underweight FMCG (no stocks except Emami) due to valuation concerns. It has a neutral allocation to IT and Healthcare. Both these segments have reasonable earnings prospects over the next 2-3 years.

So overall, the portfolio is aggressively positioned for an economic recovery with most sectors/stocks close to the bottom or early phases of the business cycle implying strong odds of higher future earnings growth.

While we do not know “when” the cycle will turn for these stocks and sectors, the reasons for “why” it will turn are getting stronger as we are close to the bottom or early stages of the earnings cycle for most of these stocks/sectors.

Question 8: Does the fund communicate in plain English the reason for the underperformance and the rationale behind the current portfolio construct?

Unfortunately, the fund falls short of this parameter. Compared to a lot of its peers, we find that public communication (via newsletters, presentations, quarterly updates, videos, etc) is lacking.

That being said, we do have access to fund managers where we have one-on-one discussions to understand the strategy, reasons for underperformance, the logic behind the calls that were taken, current thought processes, the evolution of portfolio positioning, etc.

While this provides some comfort, diplomacy aside, the lack of open and transparent communication is definitely a concern.

Verdict

Overall we think Franklin India Prima Fund is a good fund…

- Franklin India Prima fund has consistently outperformed over long periods of time

- Experienced Mid & Small Cap Fund Manager with solid long term track record & managing the fund for 14+ years

- Managed Risks well across market cycles

going through temporary underperformance…

- Franklin India Prima fund has underperformed its benchmark by 1-2% over the last 5 years and 7 years

with high odds of outperformance potential in the future (mean reversion)…

- Investment Philosophy of Sustainable Good Quality Growth at Reasonable Valuations applied consistently across market cycles

- High Conviction Buy and Hold Strategy with low churn – Portfolio has remained consistent despite underperformance pressure

- Portfolio Stocks are currently at reasonable valuations

- Positioned aggressively for economic recovery

- Most stocks and sectors at the bottom or early stages of the business cycle – Banks, Capital Goods, Real Estate, Cement, Auto etc

…Nevertheless, there are a few concerns

- If the economic recovery does not play out the fund’s underperformance may continue

- The lack of regular and transparent communication

- The AMCs handling of recent debt crisis (closing of 6 Franklin Templeton Debt Funds with high credit risk). Though the AMC has been able to gradually return the money back, it leaves a lot to be desired in terms of pro-active risk management, transparency, and communication. The solace is that the Equity team was reasonably insulated and has had a strong track record of judicious risk management over time.